Repository of the Entire Insurance Marketplace Resources

Healthcare Reform

Important dates for 2024 enrollment:

If you don’t enroll in a 2024 plan by January 15, 2024, you can’t enroll in a health insurance plan for 2024 unless you qualify for a Special Enrollment Period. How can I get coverage after open enrollment ends?

Remember… You Cannot Change Plans Outside of Open Enrollment.

2024

Medicaid, CHIP, and SHOP – apply any time

There’s no limited enrollment period for Medicaid or the Children’s Health Insurance Program (CHIP). You can apply at any time.

There’s also no limited enrollment period for small businesses to enroll in SHOP coverage for their employees. You can apply at any time.

The Medicaid Website is: http://www.michigan.gov/healthymiplan

The medicaid phone number is (800) 642-3195

If You Are Searching the Marketplace Yourself, You Must Enter Our Marketplace Id (Mrobinette) and National Producer Number (8950505) to Utilize the Services We Provide You at No Extra Cost.

Health Care Reform

There are a lot of changes coming throughout the years as the Health Care reform takes place. We would like to keep you updated on these changes and how they will affect you as an individual as well as as an employer

The SHOP is the Marketplace for small businesses. SHOP certification is not mandatory; however, we have agents who are SHOP certified. There is no additional cost for our services.

Please let your employees who are looking for individual coverage know to contact us to assist them in the Marketplace.

What is the fee for not having health insurance in 2019?

If you don’t have coverage during 2021, the fee no longer applies. You don’t need an exemption to avoid the penalty.

If you’re 30 or older and want a “Catastrophic” health plan, you may want to apply for an exemption. See details about exemptions and catastrophic coverage.

Plans Effective Beginning January 1, 2014, and Forward (Group and Individual) Must Have 10 Essential Plan Benefits:

***Please note that short term coverage does not meet the minimum essential coverage, so you will still be penalized for not have coverage

For plans effective/renewing January 1, 2014 and forward…

New Taxes and Fees will be implemented on all existing and new plans

Non-Discrimination Rules – Most health insurance carriers cannot deny or increase your coverage rate if you have a pre-existing condition; it must be covered from day one of your plan.

Individual Mandate fees for those without coverage will be implemented

Premium Tax Credits/Subsidies will be available for those people who meet a certain income bracket. If your employer offers coverage that meets minimum value criteria, you will not qualify for the tax credit/subsidy.

Reduced Cost Sharing will be implemented. This allows for people with lower incomes to have their cost-sharing reduced so that their plan, on average, pays a greater share of covered benefits.

Child only policies will be available with certain carriers

Federal Poverty Level (FPL) – The below is a chart acquired from HAP showing the estimated incomes in order to receive a subsidy/tax credit and cost sharing.

A measure of income level issued annually by the Department of Health and Human Services. Federal poverty levels are used to determine your eligibility for certain programs and benefits.

A measure of income issued every year by the Department of Health and Human Services (HHS). Federal poverty levels are used to determine your eligibility for certain programs and benefits, including savings on Marketplace health insurance, and Medicaid and CHIP coverage.

The 2023 federal poverty level (FPL) income numbers below are used to calculate eligibility for Medicaid and the Children's Health Insurance Program (CHIP). 2022 numbers are slightly lower, and are used to calculate savings on Marketplace insurance plans for 2023.

Federal Poverty Level amounts are higher in Alaska and Hawaii. Get all HHS poverty guidelines for 2023.

How Federal Poverty Levels Are Used to Determine Eligibility for Reduced-cost Health Coverage

Income between 100% and 400% FPL: If your income is in this range, in all states, you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan.

Income below 138% FPL: If your income is below 138% FPL and your state has expanded Medicaid coverage, you qualify for Medicaid based only on your income.

Income below 100% FPL: If your income falls below 100% FPL, you probably won’t qualify for savings on a Marketplace health insurance plan or for income-based Medicaid.

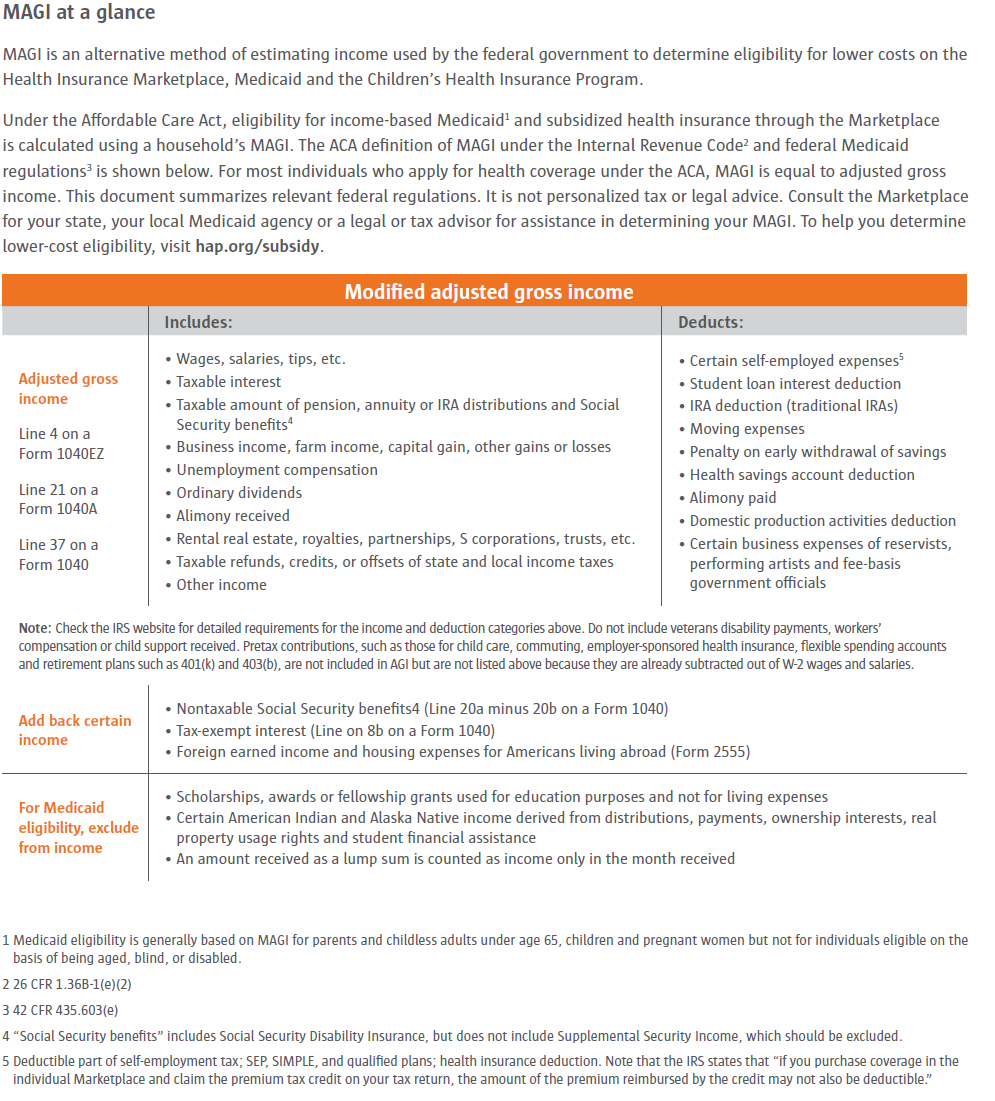

“Income” above refers to “modified adjusted gross income” (MAGI). It’s the same or very similar to “adjusted gross income” (AGI) for most people. MAGI isn’t a number on your tax return.

Federal Poverty Level amounts are higher in Alaska and Hawaii. See Alaska and Hawaii FPL information.

How to Use This Health Care Savings Chart

Most people can use the adjusted gross income to estimate income. A different figure called modified adjusted gross income is used when you fill out a Marketplace application. Learn more about estimating income.

Include in your household everyone you will claim depends on your tax return and any children who live with you. Be sure to include their income when you estimate your household income. Learn more about who to include in your household.

If you’re married, you must file a joint tax return to get lower costs on Marketplace coverage based on your income. Note: If you’re a victim of domestic abuse, domestic violence, or spousal abandonment, you may not have to file jointly

If your estimated income is too high to qualify for savings, learn about your options for buying coverage.

Modified Adjusted Gross Income chart brought to you by HAP:

Small Business Coverage:

For plans effective/renewing January 1, 2014:

Minimum of 90 days waiting for the period for new/eligible employees (1st of the month following 90 days will not be allowed)

Employee count will be not be based on Full-Time Eligible Employees but Full-Time Equivalents (Full and part-time employees combined)

Disclaimer: “This calculator provides a general overview of certain aspects of health care reform based on information currently available. It does not cover all of the requirements, and new information is released frequently. This website's information about health care reform is offered as an educational tool and should not be considered legal advice. The effect of reform on your business may differ depending on your circumstances.”

Disclaimer: Please be aware that this taxes/fees schedule and calculator may be specific to Priority Health; Certain pricing and tax factors were developed based on each carrier’s approach. The factors and methodology for calculating these amounts for other carriers could be very different. This is here to give you an estimate only. Your plan and carrier’s taxes and fees may differ.

Pediatric Dental and Vision will be required for all children 18 and under. If you have proof of dental through another carrier, this fee for dental may be waived. The fee is estimated at $20-$30 per child with a maximum fee of 3 (this may vary by carrier.

Essential Benefits will be embedded on plans effective 2014

Wellness Incentive Rewards may be available – a program to promote health by offering incentives such as discounted premium, gym memberships, etc.

Disclaimer: “This calculator provides a general overview of certain aspects of health care reform based on information currently available. It does not cover all of the requirements, and new information is released frequently. Information provided by Priority Health about health care reform is offered as an educational tool and should not be considered legal advice. The effect of reform on your business may differ depending on your circumstances.” This calculator is here to give you an estimate only. Please use the website www.irs.gov for more exact calculations or visit your tax accountant.

Individual Premium Tax Credits/Subsidies will be available for those people who meet a certain income bracket. If your employer offers coverage that meets minimum value criteria, you will not qualify for the tax credit/subsidy.

Cost Sharing Limits will be implemented. Deductibles and out of pocket maximums will be limited to a certain dollar amount depending on your plan

Businesses with 50 + Full-Time Equivalents could face a penalty in 2015 if they are not offering health coverage that does not meet minimum value to their employees

Businesses with less than 50 Full-Time Equivalents will not face a penalty for not offering health insurance.

Disclaimer: The information listed has been reworded for better understanding. It is an overview of some of the Health Care Reform topics. It does not cover all topics or all of the requirements of The Health Care Reform. This is strictly a learning tool. This information is not to be used legally or as advice. This information may change frequently, so please visit healthcare.gov or www.cms.gov for more detailed information.