Client-Focused Insurance Policies

Health

Open enrollment is 11/01 – 01/15. November 1st applications will start a January 1st effective date.

Whether you are an individual or employer interested in buying coverage or just looking for a quote, there are several different plans out there. It is important to know the differences.

All of the plans are now categorized by Medal tiers: Bronze, Silver, Gold, and Platinum. Please keep in mind that if you are eligible for a tax credit, you can use that in any category; however, cost-sharing is only available in the Silver category.

Terminology

This means your provider has a contract with the health insurance network/carrier, and he/she cannot charge more than the agreed amount for a service. Since there is an agreed amount, you tend to benefit your plan by using an In-Network provider.

Individual Quote Form

Employer Quote Form

Dental

A few things to know about dental insurance. Please keep in mind that there is a difference between employer dental benefits and individual dental benefits.

There are several types of plans:

Flat Fee: The insurance company pays a flat fee for each given service.

Fee Schedule: This is when the insurance company pays a given percentage for a service; you are responsible for the rest.

Maximum Allowable fee: The maximum fee allowed to be paid for a service by the insurer for in-network service. This allows for less of a balance bill at a dentist out of network.

In-Network fee: The fee schedule in which the insurer pays the average network fee for a service. Out of network, you are more likely to have a balance bill.

There are four classes of services: Preventative (Class I), Basic (Class II), Major (Class III), and Orthodontics (Class IV).

The coverage under each of these services tends to vary by carrier and plan type

There is typically no deductible on the Class I services (unless your plan has a lifetime deductible rather than an annual deductible)

Class II and III typically have a combined annual deductible. In other words, if you pay the deductible in Class II, you will not pay it again in Class III.

Class IV services typically do not have a deductible but rather a waiting period and a lifetime maximum (a cap on the amount a carrier will pay out in someone’s lifetime). Generally, these benefits are only applicable to those under 19 years of age. Not all plans have Orthodontics available, but this class is usually an added rider at an additional cost if this is available.

Examples of services:

Employer dental plan

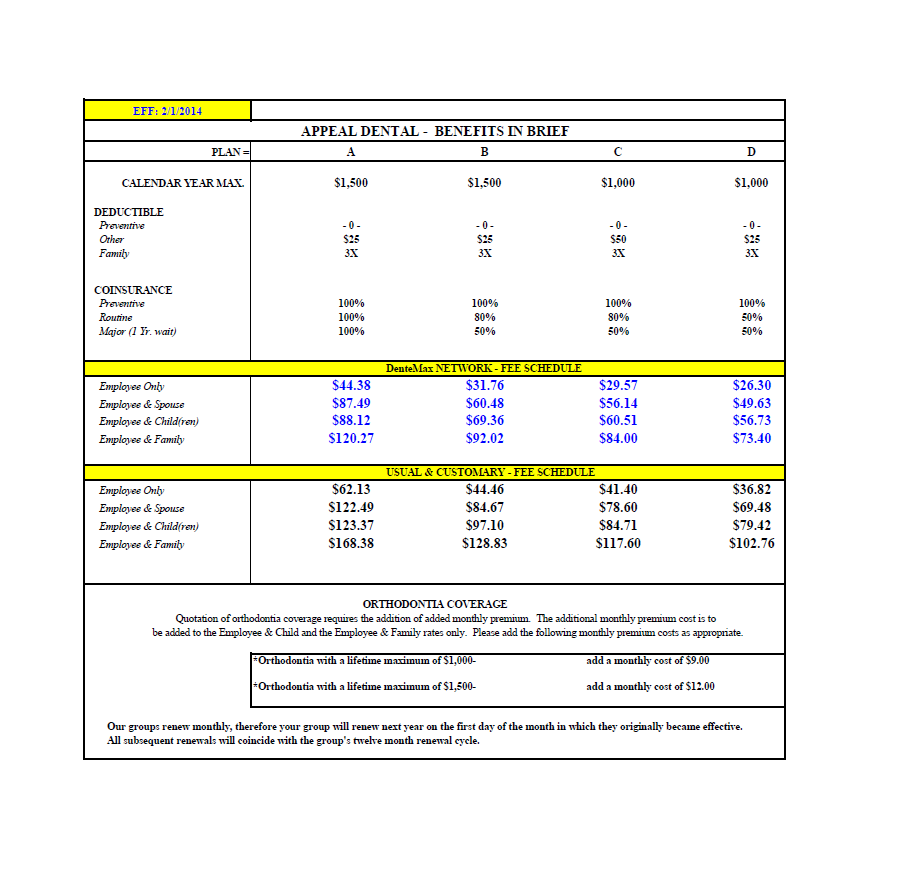

Please see below for some guaranteed issue employer dental plans and rates through one of the carriers we represent, Liberty Union – Appeal dental

Employer Quote Form

Life & Disability

There are several different forms of life insurance and several options that can be added to each policy; the below is a generalization of the most common forms:

Whole life is a policy that will follow you throughout your entire life. These policies can be taken out in different face value amounts, and they are made to follow you through your entire life; however, at a certain age (whatever the policy is deemed to go up to), for example, age 125, if you are still alive, you will get the face value on the policy. The proceeds from such a policy are typically used for burial expenses and other expenses that may be left behind. Whole life policies build cash value, which can be used to pay your premium after a certain policy point. The interest rate on these policies is guaranteed. You can also borrow against the cash value of such a policy, and the amount borrowed would come off of the face value of the policy.

There are a few different Universal Life types, and I have found the most common to be Universal Life with a guaranteed death benefit. This means that the policy will follow you through your entire life; however, at a certain age (whatever the policy is deemed to go up to), for example, age 125, the policy will end if you are still alive. The proceeds from such a policy are typically used for burial expenses and other expenses that may be left behind. This policy will build some cash value, but there is no guaranteed cash value like there is on a whole life policy. The cash value is usually much lower than a whole life policy because the interest rates given for this type of policy can fluctuate but are not guaranteed; however, there is a minimum amount that is guaranteed, thus the guaranteed death benefit.

you can also select how long you want to pay premiums; for several years or up to a certain age. For example, you could pay a policy up in 5 or 10 years to have no additional premium you would owe. This, of course, will cost more money for the 5 or 10 years then you would pay without this option.

Term life is a policy made to cover you for a certain number of years. Term life tends to be the lowest cost life insurance because it is not made to follow you through your entire life. For example, term life can be elected for ten years, 15 years, 20 years, or 30 years. Term life is usually elected to help cover expenses, such as a mortgage, in the case of an unexpected death. At the end of a term life policy, you could choose to continue the policy at a higher rate than you were paying. The reason someone would do this would, for example, be if a health status changed and medical underwriting could not be passed again.

This means that if you leave that place of employment, you will lose that life insurance coverage unless (if available) you select the option to convert the policy. These policies are not usually medically underwritten and tend to be guaranteed if the face value is under a certain amount. If your employer offers this coverage, it is a plus, especially if you do not think you could pass medical underwriting on an individual policy.

**It is important to know that there is a clause regarding a specified amount of time that must pass for coverage under certain circumstances on most life insurance policies. An example would be that there is a specified amount of time; you must have the policy before suicide would be covered if covered at all and not excluded. Some policies may rider certain things out entirely. Most policies have a two-year probationary or look back period, which means that, for example, if on your application you said you were a non-smoker. You died due to lung cancer within the two years. The insurance carrier could look back and investigate to find out if you were a smoker when you applied, and if in fact, you had lied on your application.

Many individual life policies are medically underwritten, meaning that you could be denied or your rate could be raised due to medical history; however, not all individual policies are medically underwritten. Pre-screens can be done on medically underwritten policies to determine if you would be denied coverage or to determine an estimated rate increase.

There are also additional options that can be added to some of the above policies, some of which are:

This is common on a term policy; however, it can be found on other policies during certain years on the policy. With this option, you typically pay about double in premium to have this option, but at the end of the term of your policy, if you are alive, you would receive your premium back.

This is automatically included in some policies and not in others. This option would waive your premium for a certain period due to certain circumstances. Some circumstances for waiver of premium could/maybe: a disability, loss of a job, etc.

This option will pay additional money to the beneficiary if an accident caused death. If there is dismemberment such as loss of a limb, loss of sight, or loss of a bodily part, the policy will pay a certain amount due to that loss.

Disability Insurance

Long and Short Term Disability can be purchased individually or through an employer. If it is purchased through an employer, it can be a voluntary plan (meaning the employees pay for the insurance themselves) or contributory (meaning the employer pays a portion of the premium).

Vision

Vision Insurance can be purchased as an individual benefit; however, as an individual benefit, most of the time, it has to be purchased with a dental plan from a carrier that offers both individual dental and individual vision. Not all carriers offer individual vision, just as not all carriers offer individual dental.

Group vision insurance can be voluntary, meaning the employee pays the premium for his/her coverage, contributory; meaning the employer pays part of the cost of the insurance, or non-contributory; meaning the employer pays the full cost of the insurance.

Vision insurance typically has four categories: exams, lenses, frames, and contacts. Rates can differ based on two plan factors: copays and frequencies. The copay is the dollar amount you pay out of pocket for that service (for example, you may have to pay $10 out of your pocket for an eye exam). The frequency is how often you can go for that particular service/item. For example, 12/12/24/24 would mean you can get an eye exam and lenses every 12 months, but new frames or contacts only every 24 months.

Although some do, most contracts only cover regular plastic lenses, provide limitations on the price of frames and contact lenses, and do not cover extras such as tint/anti-glare. Some plans also will cover contacts instead of glasses, so you may have to decide between one or the other being covered.

Medicare Supplement

Contact Thomas Robinette for more information regarding Medicare Supplement [email protected]

Click here HAP Medicare Supplement Products

Disclaimer: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.

Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Global/Travel Insurance

We also sell travel policies for groups, individuals and/or students! Travel insurance can last for a short period (a few days) or a long period (several years). Travel insurance will provide you with extra protection when you are traveling out of the country.

When purchasing travel insurance, please be sure to know if your plan covers pre-existing conditions (some policies will and some will not). Also, be sure you know what your policy excludes, as some riders can be added on to cover things that would not be covered under the basic policy.